January 2026 didn’t arrive with fireworks. There was no dramatic sense of starting over, no loud declarations about change, no feeling that the year had flipped a switch.

Life continued much the same on the surface. People went back to work, paid bills, ordered groceries, and planned weekends.

Yet beneath all of that normalcy, something subtle began to take shape. The way Americans were thinking about money felt different, even if no one could quite explain how.

Spending didn’t stop. Stores stayed busy. Online carts were still filling up. But the energy behind those consumer spending decisions softened.

Impulse gave way to hesitation. Confidence made room for pause. It wasn’t fear driving the moment — it was awareness. A quiet sense that money now deserved more attention than it used to.

This wasn’t the kind of shift people talk about openly. It didn’t come with new rules or resolutions. It showed up in small moments, easy to miss unless you were paying attention.

A longer pause before tapping a screen. A second glance at a balance. A feeling that something had changed, even if nothing obvious had.

What People Are Doing Instead of What Headlines Expect

For years, the story around money swung between extremes. Either Americans were supposed to shut everything down and stop spending, or bounce back into carefree confidence the moment pressure eased.

But 2026 didn’t follow that script. Instead of pulling back completely or charging ahead, people settled into the space in between.

Purchases still happen, but they come with a quiet check-in first. Phones get picked up late at night, not for scrolling, but for a quick look at an account.

Decisions that once took seconds now take longer, filled with small quiet money decisions that rarely reach the surface. It’s not about guilt or restriction. It’s about awareness.

There’s a softness to these moments. A sense of thinking things through without dramatizing them. People aren’t announcing restraint or celebrating discipline.

They’re simply moving more slowly, as if giving themselves permission to pause before committing.

Why This Is Happening Now

This shift didn’t appear out of nowhere. It’s the result of years spent reacting.

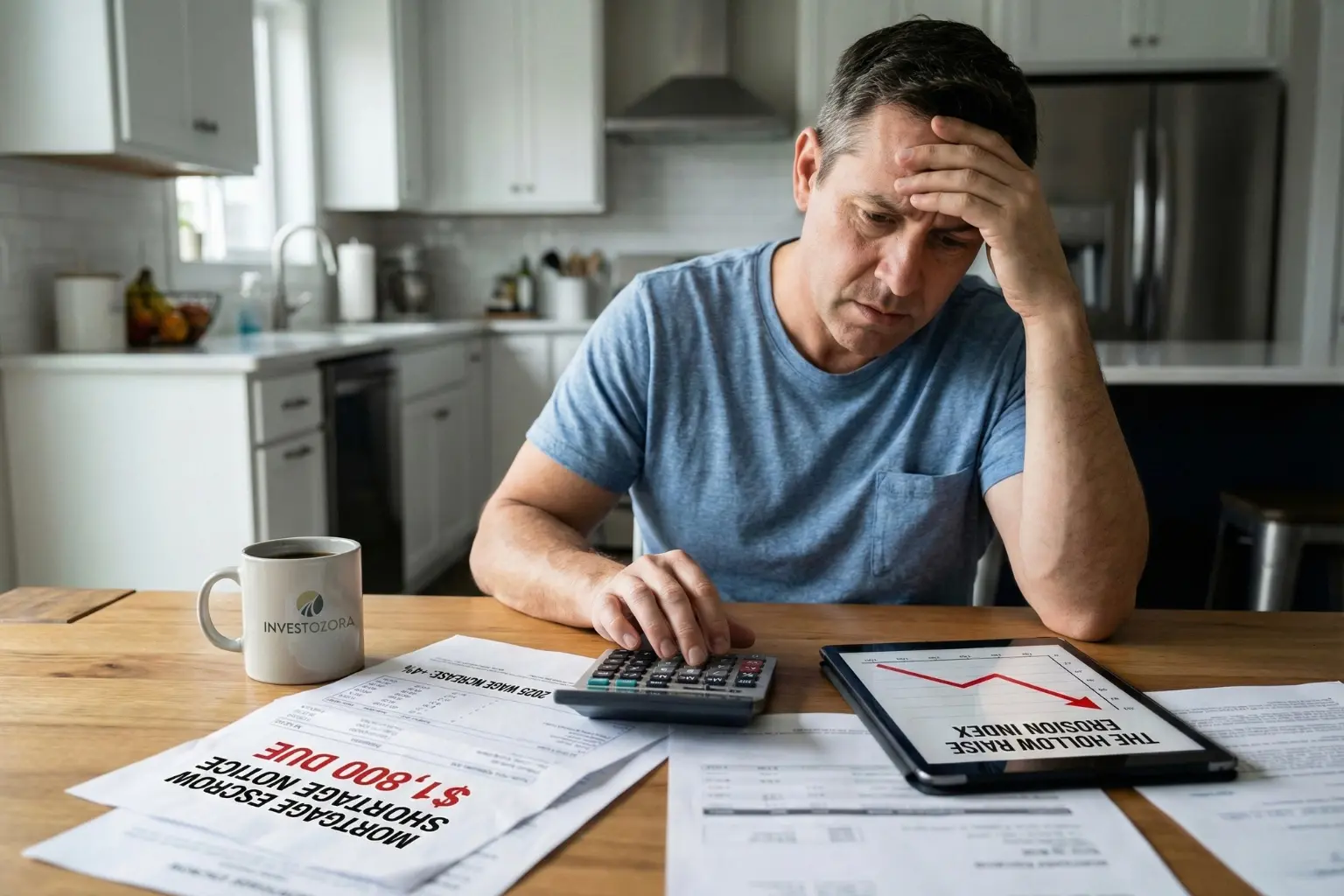

Inflation data, economic uncertainty, and constant warnings about what might go wrong next have left a mark. Over time, that kind of pressure wears people down. Staying on edge becomes exhausting.

Eventually, reaction turns into adjustment. Instead of responding emotionally to every new signal, people begin to protect themselves quietly.

They stop trying to predict what’s coming next and focus instead on quietly changing money habits to stay steady where they are. This isn’t optimism, and it isn’t fear. It’s fatigue turning into calm.

What’s happening now feels less like a strategy and more like a reset of emotional energy. People are tired of swinging between extremes. They want something sustainable, even if they can’t yet define what that looks like.

The Psychology Behind Modern Money Choices

Many Americans describe their situation with a strange mix of words. They feel okay, but not safe. Stable, but not secure.

Comfortable enough to enjoy small pleasures, yet hesitant to take on big commitments. That tension shapes nearly every decision, even when it goes unspoken.

Even the Federal Reserve notes that well-being often lags behind raw economic data. Small comforts still matter. They bring relief, normalcy, and a sense of control.

Bigger choices, though, carry more weight than they used to. They feel permanent. Risky. Harder to reverse. Avoiding them isn’t about fear — it’s about preserving flexibility.

Money, in this moment, isn’t just a tool or a resource. It’s emotional. It represents safety, effort, and future uncertainty all at once. That’s why people are so careful with it now, even when they aren’t consciously trying to be.

What This Means Inside American Households

These quieter changes show up most clearly at home.

Couples talk a little more before deciding. Parents think further ahead without turning those thoughts into rigid plans.

Younger adults pause timelines they once felt rushed to follow, choosing to wait rather than force momentum. Even as student loans become a reality for many, the approach is more calculated.

Saving happens too, though few people call it that. It looks more like holding back when possible. Leaving a bit of space. Choosing not to commit right away.

Government data on personal saving shows these rates fluctuating as people try to find their footing. No one frames these behaviors as sacrifice.

They feel practical, almost natural. A way of staying grounded in a world that’s felt financially stuck for a long time.

Why This Shift Matters More Than It Seems

Big economic changes don’t always announce themselves through crashes or booms. Sometimes they emerge quietly, shaped by millions of small decisions made at the same time.

A collective slowing. A shared hesitation. A new sense of what feels reasonable.

These subtle adjustments influence everything that follows. How confident people feel saying yes. How easily they say no.

And how long they’re willing to wait before committing to low risk investments. Over time, these patterns reshape expectations, behaviors, and even the definition of stability itself.

What makes this moment powerful is its quietness. There’s no single event to point to, no dramatic turning point. Just a gradual money shift in how Americans relate to the future.

The Quiet New Normal

America doesn’t feel afraid right now. It doesn’t feel bold either. It feels careful. Thoughtful. A little tired, but more self-aware than before.

The constant noise has faded, replaced by a calmer, more deliberate relationship with money. This may be the new normal. Not dramatic. Not decisive. Just intentional.

A way of moving forward without rushing, reacting, or pretending everything is fine. In its own quiet way, that carefulness says more about where the country is headed than any headline ever could.

Author

-

The information on this site is for educational and general guidance only. It is not intended as financial, legal, or investment advice. Always consult a licensed professional for advice specific to your situation. We do not guarantee the accuracy, completeness, or suitability of any content. For complete details, please review our full disclaimer.