As the mid-February tax season reaches its peak, a wave of sophisticated fraud attempts has emerged across the United States. Following the surge in public interest regarding a rumored $2,000 federal deposit scam alert, federal agencies are warning taxpayers to remain vigilant.

Cybercriminals are currently exploiting the confusion surrounding eligibility conditions and the SSDI SSI payment schedule to steal personal information and drain bank accounts.

Understanding the difference between an official government communication and a targeted phishing attempt is the most critical step in maintaining your financial stability this quarter.

How the $2,000 ‘Direct Deposit’ Scam Works

The current scam typically arrives via text message (SMS) or email, designed to look like an official notification from the Internal Revenue Service or the Social Security Administration.

The message often claims that your “$2,000 Federal Deposit” is pending and requires immediate “verification” of your bank account details or Social Security number.

These fraudulent messages often include a link to a website that perfectly mimics an official government portal. Once a user enters their credentials, the attackers gain full access to their tax filings and personal financial records.

It is important to remember that the IRS never initiates contact with taxpayers via text or social media to request sensitive financial information.

Red Flags of a Federal Payment Scam

To protect your money management strategy, look for these three critical red flags that indicate a payment notification is fraudulent:

- Requests for Immediate Action: Scammers create a sense of urgency, claiming your payment will be “forfeited” if you don’t click the link within minutes.

- Unverified Links: Official government websites always end in .gov. If the link contains “https://www.google.com/search?q=irs-benefits.com” or “gov-checks.org,” it is a malicious site.

- Direct Deposit Pings: If you receive a notification for a federal deposit that you didn’t apply for or wasn’t officially authorized, it is likely a trap.

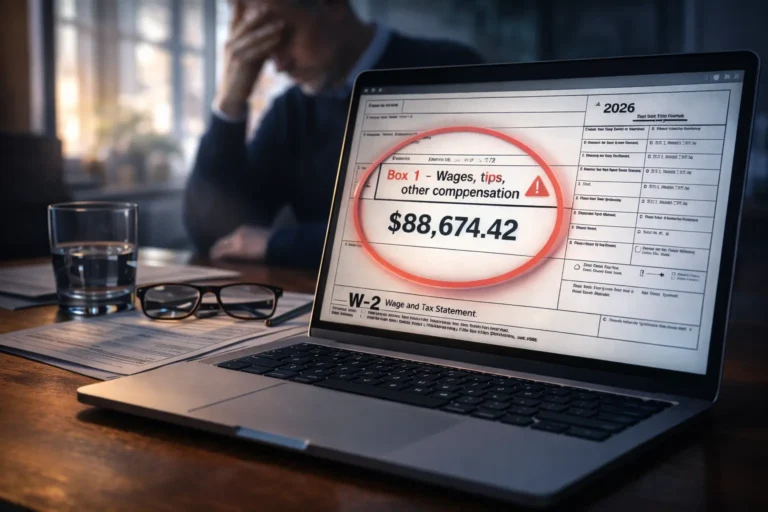

The Danger of ‘Box 1’ Data Harvesting

Some advanced scams are now specifically targeting the W-2 Box 1 discrepancy that we recently identified. Attackers may send messages claiming that your “Box 1 is incorrect” and offer to “fix it online” for a fee.

This type of data harvesting is particularly dangerous because it targets high-earning households who are already anxious about their tax returns.

Official corrections to your income must always be handled through a formal W-2c form from your employer, never through a third-party link.

How to Verify Your Payment Status Safely

If you are expecting a legitimate refund or benefit. The only way to check your status safely is through official, verified channels:

- Where’s My Refund? Use the official IRS.gov tool to track your tax return progress.

- My Social Security Account: Use the SSA’s secure portal to view your upcoming direct deposit dates.

- Check Your Bank App Directly: Never click a link in a text message to check your balance. Log in to your bank’s official app or website manually.

Staying informed through these channels prevents the financial anxiety that leads to hasty, risky clicks.

Protecting Your Identity in 2026

The increase in federal payment scams highlights the importance of overall financial fragility awareness. As we move deeper into February. Ensure that you have two-factor authentication (2FA) enabled on all financial accounts and your primary email.

Reporting these scams helps federal agencies track and shut down malicious domains. If you receive a suspicious message, you can report it to phishing@irs.gov or through the FTC’s reporting portal.

By maintaining strict financial discipline, you can protect your hard-earned wealth from the growing wave of digital fraud. Your safety remains the most important part of a successful tax season.