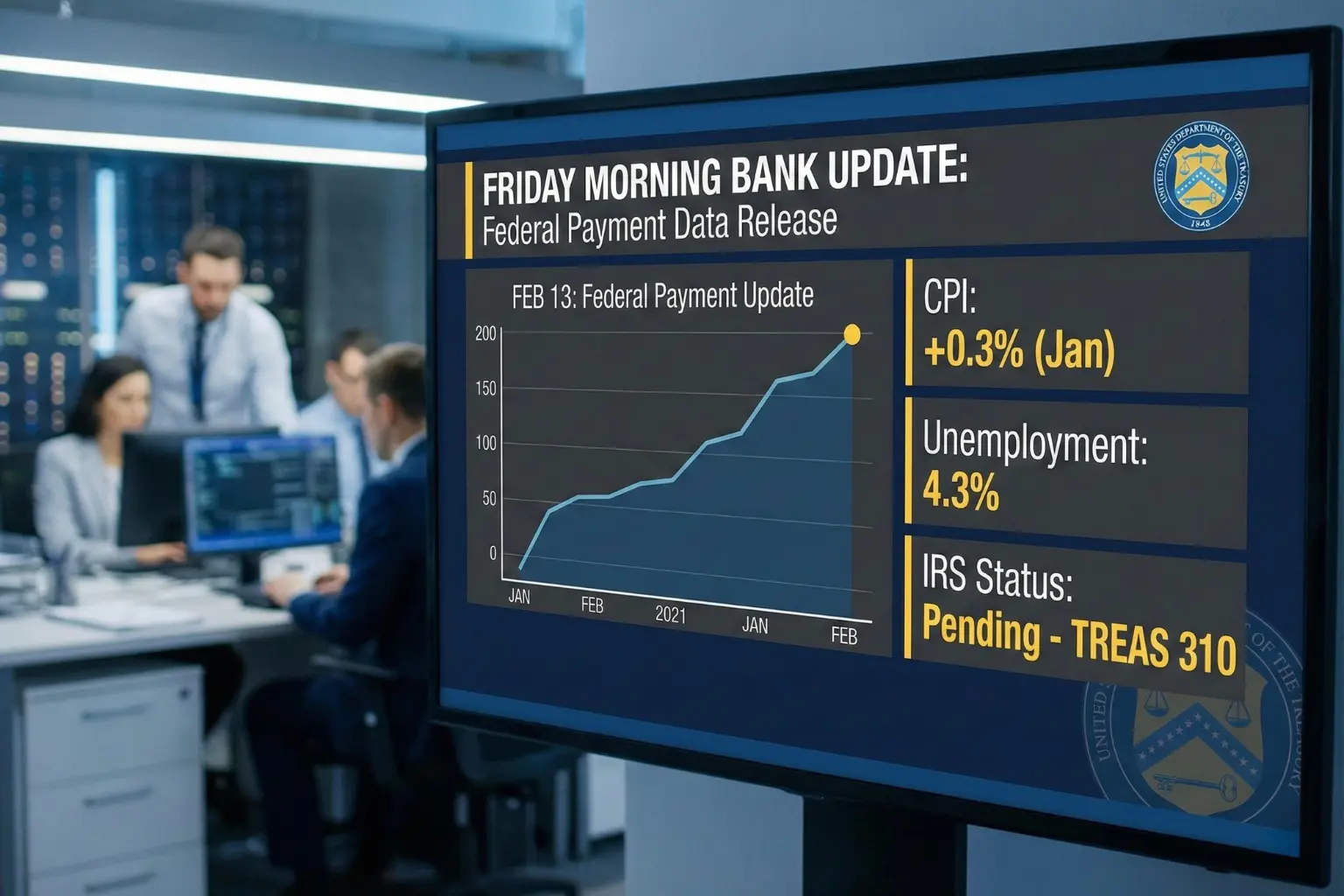

The financial landscape for millions of Americans shifted at 8:30 AM EST today, Friday, February 13. Following a brief federal government shutdown, a massive wave of data has just been released by the Bureau of Labor Statistics (BLS) and the U.S. Treasury.

This data dump includes the long-awaited January Consumer Price Index (CPI) and updated rules for pending direct deposits.

If you are currently looking at a pending notification in your banking app, you are part of a larger structural movement involving 164 million tax returns and 71 million Social Security beneficiaries.

Understanding these specific numbers is the only way to navigate your household liquidity this weekend.

The 4.3% Shift: New Labor and Inflation Data

Today’s federal report confirms that the unemployment rate has fallen to 4.3%, down from 4.4% in December.

While this signals a stabilizing job market, the January CPI report shows a steady 0.3% monthly increase in consumer prices.

This January effect is often when firms raise prices after the holiday season. And it directly impacts the real value of your upcoming Social Security checks.

Because inflation remains stubbornly above the Federal Reserve’s 2% target, the purchasing power of your $1,000 Trump Account seed money is under immediate pressure.

The government is using this inflation data to recalibrate the 2.8% COLA increase that was built into February payments. Meaning your dollar is buying roughly 2.7% less than it did this time last year.

Why $2,000 Deposits are Sitting in Pending Status

The Treasury’s interim financial statements released today show that revenue collection is stronger than expected. Yet direct deposits are moving slower.

This is due to a security batching process implemented to stop the $2,000 federal deposit scams that targeted households earlier this week.

If your status is stuck on IRS TREAS 310, your bank is likely performing a final name-match verification.

According to the official IRS schedule, most Earned Income Tax Credit (EITC) and Additional Child Tax Credit (ACTC) refunds will not be fully available in bank accounts until March 2, 2026.

However, for those without these credits, today’s “Friday Morning Update” is the primary clearing window for the week.

The Weekend Deadline for Child Savings

The most urgent data point released hours ago concerns the Monday, February 16 enrollment deadline. The $1,000 Trump Account pilot program requires parents to link their verified W-2 Box 1 data before midnight on Sunday.

Because the IRS is phasing out paper checks this year. Failing to provide direct deposit information by this deadline could result in a six-week delay or the issuance of a CP53E notice.

To avoid this velocity leak, you must ensure your banking routing numbers are updated in your IRS Online Account before the weekend processing begins.

What to watch in your account today

As the US markets digest the 8.5% rise in fuel oil and the 10.8% jump in natural gas prices reported this morning. Your focus should be on your immediate liquidity.

- Watch for the “Refund Approved” status in the IRS2Go app.

- Compare your Social Security birth date against the February 18 and February 25 payout waves.

- Move any cleared funds into a high-yield savings account to outpace the 0.3% monthly inflation rate.