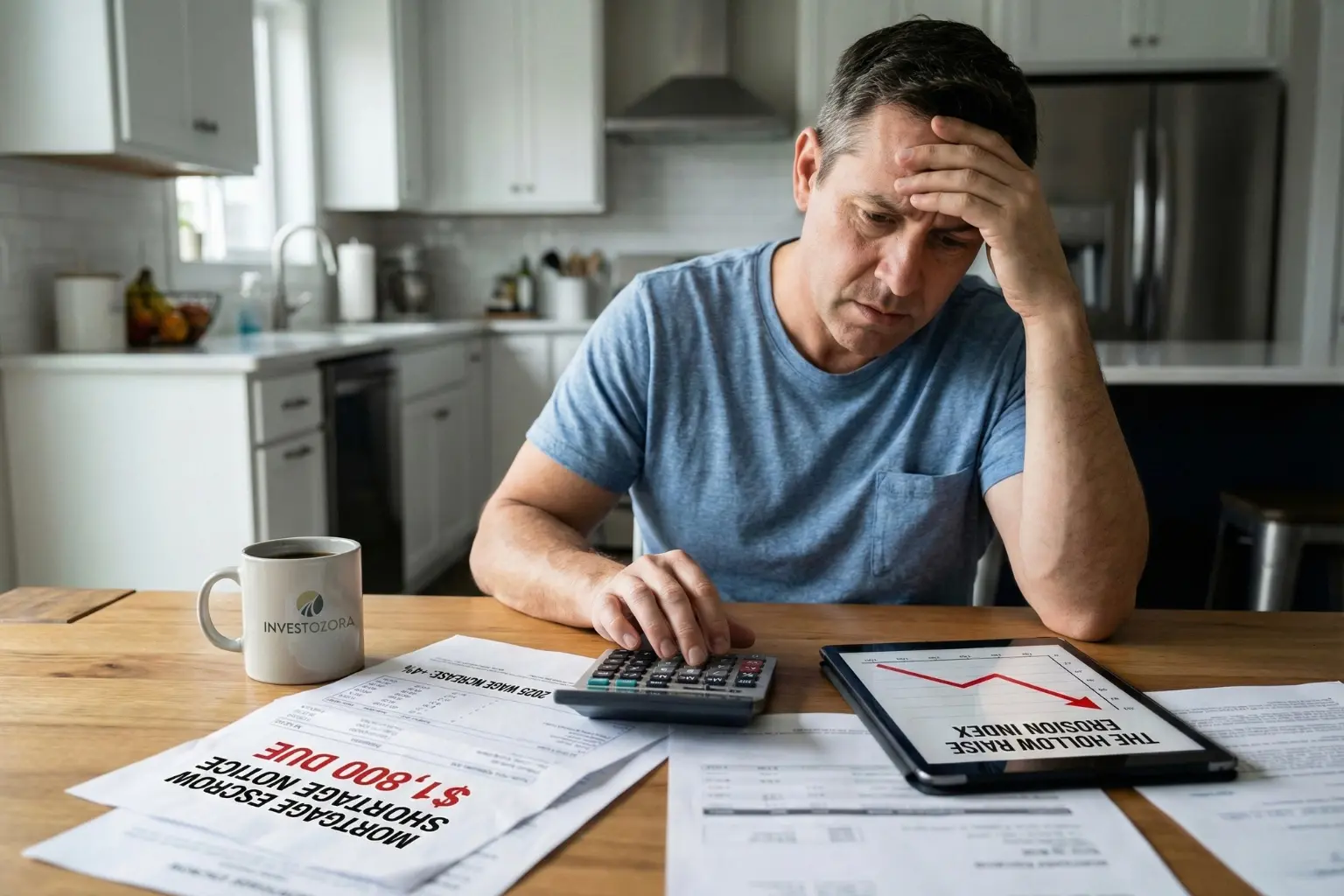

On paper, the American middle class got a raise in 2025. In reality, that money was spent before it ever hit their bank accounts.

While inflation headlines have softened, a silent crisis in the housing sector specifically the Escrow Shortage is acting as a hidden tax on household liquidity.

New analysis by Investozora projects that for homeowners in high-risk insurance zones, $0.65 of every new dollar earned in 2026 wage increases is being absorbed solely by rising insurance premiums and property tax adjustments.

The result? A Hollow Raise. Families feel richer on their W-2s, but poorer in their checking accounts.

- New analysis reveals that 65% of the hard-won wage growth from 2025 has effectively evaporated, instantly absorbed by double-digit spikes in homeowner insurance premiums across high-risk zones.

- While technical salary increases look positive on paper, fixed housing costs are now outpacing income growth, forcing middle-class families to bridge the monthly liquidity gap with revolving credit card debt.

- The data paints a stark picture of a Hollow Raise, where a typical household’s $2,300 net annual income boost is almost entirely neutralized by an unexpected $1,800 surge in escrow requirements.

- With real disposable income shrinking month-over-month despite higher wages, economic indicators are now signaling a probable contraction in broader retail spending as consumer liquidity dries up by April 2026.

The Math Behind the Misery

To understand why the january money shift feels so aggressive this year, we have to look at the net benefit of the 2025 salary cycle.

According to recent labor data, average US base pay increased by approximately 3.5% to 4% last year. For a household earning $75,000, that is a gross increase of $3,000.

After federal and state taxes approx. 22%, that leaves a real cash increase of $2,340 for the year. That sounds like progress. But then the mail arrived.

Insurance industry reports indicate that homeowner premiums in many states surged by over 11% to 20% in 2025. When combined with higher property tax assessments, the average “Escrow Shortage” for these households is landing between $1,500 and $1,800 per year.

Here is the Investozora Erosion Calculation:

- Net Wage Gain: +$2,340

- Escrow/Fixed Cost Hike: -$1,800

- Remaining “Real” Raise: +$540

That is not a raise. That is a rounding error. This helps explain why so many americans feel financially stuck despite positive jobs reports. The data suggests that for millions of families, the recovery money is merely passing through their hands on its way to insurance carriers and county tax collectors.

Projecting the Hollow Raise: 2025 Wage Gains vs. 2026 Housing Costs

To visualize this erosion, we modeled the net financial impact on a typical median-income household receiving a standard cost-of-living adjustment. The breakdown below illustrates how quickly the on-paper gain is neutralized by the single variable of escrow inflation, leaving the household with negligible new liquidity.

| Income Scenario (2025–2026) | The Numbers | Impact on Wallet |

|---|---|---|

| 2025 Base Salary | $75,000 | Baseline |

| 2025 Wage Increase ~4% | +$3,000 | Gross Raise |

| Federal/State Taxes est. 22% | -$660 | Tax Deduction |

| Net Take-Home Raise | +$2,340 | What you think you got |

| 2026 Insurance/Escrow Hike | -$1,800 | The Silent Tax |

| REAL Remaining Cash | +$540 | The Actual Raise |

| Monthly Real Benefit | $45.00 | Too small to feel |

The Liquidity Trap

This erosion of disposable income creates a dangerous liquidity trap. In previous years, a $2,000 net raise might have gone into average retirement savings or a college fund.

In 2026, that capital is effectively frozen. This is driving the sudden spike in revolving credit usage. When fixed costs Mortgage, Insurance, Auto eat up 100% of the new income, variable costs groceries, gas must go on plastic.

We are already seeing this play out in the credit card debt january figures. The rise in balances isn’t necessarily from consumer excess; it is a mathematical reaction to the mortgage escrow shortage.

When your fixed housing payment jumps by $200 a month, but your paycheck only grew by $195, the math forces you into debt to maintain the same standard of living.

The January Effect Complication

The timing makes this worse. This escrow shock is hitting mailboxes at the exact same moment as the annual january paycheck drop.

Most workers forget that social security withholdings reset in January. If you maxed out your FICA contributions late last year, you saw a temporary bump in take-home pay in November and December. That bump disappeared on January 1st.

Combined with the confusion surrounding $1,500 – $2,000 federal payments, many households entered Q1 with inflated expectations of their cash flow. The reality check has been swift and brutal.

What This Means for Q2 2026

If this trend holds, the strong consumer narrative may hit a wall by April. Liquidity is the fuel of the US economy. When that liquidity is diverted to non-productive assets like higher premiums for the exact same insurance coverage, retail spending inevitably slows.

We are watching for a quiet contraction. Families aren’t announcing they are broke; they are just making a quiet money shift canceling subscriptions, delaying car repairs, and swapping brands at the grocery store.

The Bottom Line

The economy is currently in a tug-of-war between rising wages and rising fixed costs. Right now, fixed costs are winning. If you received an escrow shortage notice this month, do not ignore it. It is not just a bill; it is a signal that your real wage has dropped.

The Strategic Move: Treat this week as a financial reset after holidays. Re-calculate your monthly surplus using the new mortgage number, not the old one. If the math doesn’t work, it is time to check your emergency fund amount and prepare for a tighter year.

The Hollow Raise is real. The sooner you adjust your budget to match it, the safer you will be.

Methodology

About This Analysis: Investozora’s Hollow Raise projection models the intersection of BLS Employment Cost Index data Q4 2025 against average residential insurance premium adjustments in high-risk states FL, CA, TX. The model assumes a standard fixed-rate mortgage with an escrow account adjustment occurring in Q1 2026. Tax estimates include Federal and FICA withholdings but exclude specific state deductions.

Investozora uses only trusted, verified sources. We focus on white papers, government sites, original data, firsthand reporting, and interviews with respected industry experts. When relevant, we also use research from reputable publishers. Every fact is checked against a primary source so readers get clear, accurate, and up-to-date information, and we update our citations whenever official guidance changes.

- U.S. Bureau of Labor Statistics — Employment Cost Index – Official federal data tracking wage growth, compensation trends, and labor costs.

- Insurance Information Institute (III) – Industry research and outlooks on insurance pricing, premium trends, and risk factors.

- S&P Global Market Intelligence — Insurance Sector – Market-level analysis of insurance companies, pricing dynamics, and sector performance.

- Internal Revenue Service (IRS) – Official U.S. tax authority providing guidance on payroll taxes, withholding, and federal tax policy.