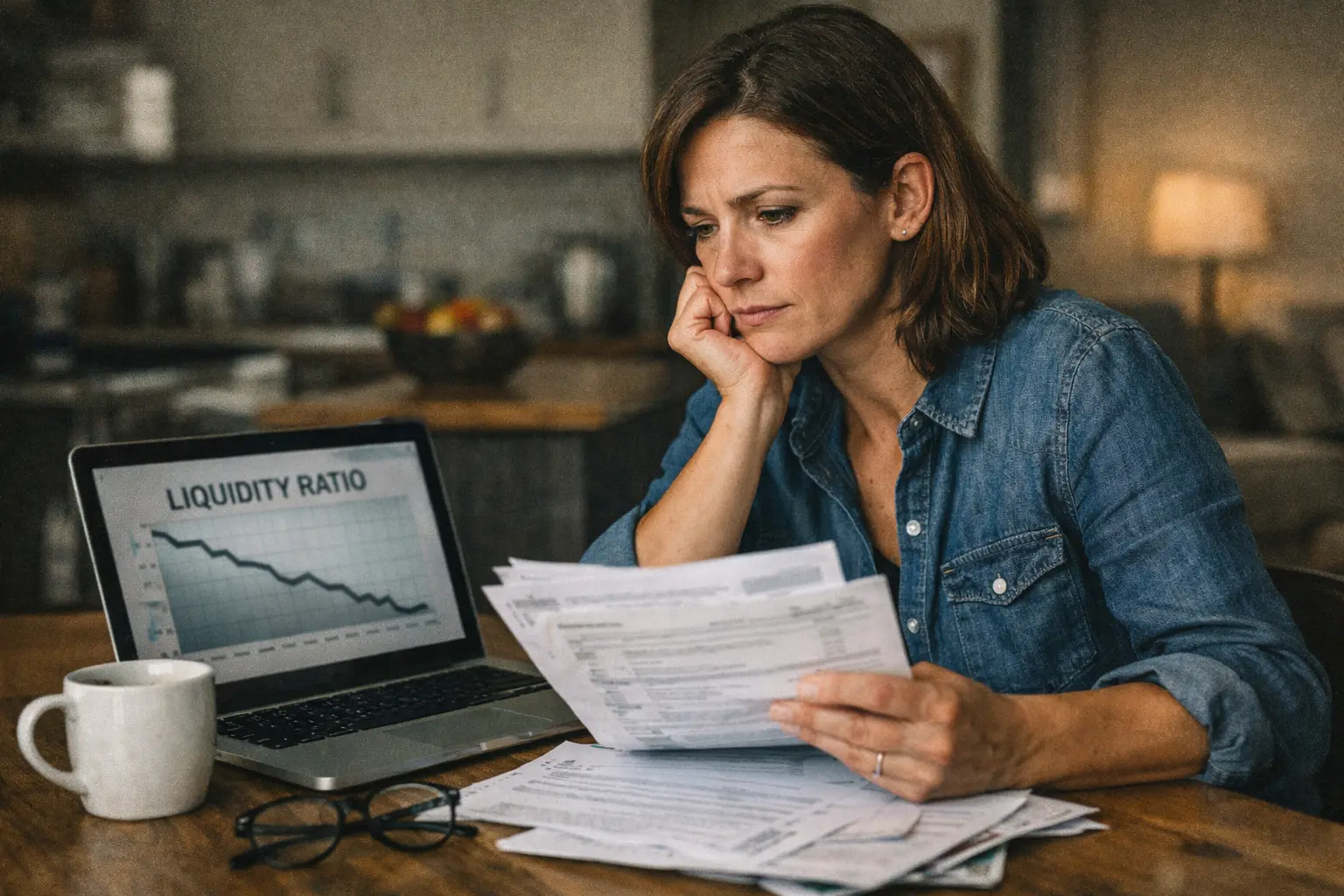

On paper, many American households earn enough to feel secure. Paychecks arrive, benefits clear, and monthly income looks stable. Yet financial anxiety still builds between deposits, bills, and everyday expenses.

What most people experience as stress is often not about how much money they earn, but when that money becomes usable.

Beneath every deposit sits a settlement system that moves funds through clearing windows, processing layers, and institutional timing rules before households can actually spend it.

By the end of this article, you’ll understand why liquidity timing — not income — quietly determines household stability, how settlement mechanics shape cash flow behavior, and why money does not simply “arrive,” but moves through structure.

The Hidden Rhythm of Household Cash Flow

Household finances are usually discussed as monthly totals. Income minus expenses. Savings goals versus spending habits. But real life does not move in neat monthly blocks. It moves in days, processing windows, and clearing cycles.

Rent may hit before payroll clears. Utilities auto-draft while deposits still show pending. Credit card payments process on one calendar system while wages flow through another. These mismatches are not budgeting failures. They are timing friction.

When liquidity arrives after obligations, households bridge the gap with overdrafts, credit cards, or delayed payments. Over time, even stable earners begin to feel financially fragile — not because income is low, but because access to funds is structurally uneven.

This is why many families who technically “earn enough” still live with constant cash tension.

How Money Actually Becomes Spendable

Every deposit passes through settlement layers before it becomes usable liquidity. Employers initiate payroll files. Banks batch them through clearing systems. Networks verify, post, reconcile, and release funds according to institutional schedules.

Until those steps finish, balances may appear on apps but remain unavailable.

The mechanics behind this flow are not random. They are engineered for risk control, fraud prevention, and interbank certainty. Institutions prioritize accuracy and system stability over consumer immediacy.

The result is predictable delay.

A paycheck sent on Friday may not become usable until Monday or Tuesday. Government payments follow similar structured windows. Even instant-looking deposits often rely on pre-funding and reconciliation afterward.

For households, this means income timing is governed by infrastructure — not employer generosity or bank preference. Understanding the broader flow of the money movement system reveals why access lag is built into modern finance.

Timing Friction and Financial Stress

When liquidity timing misaligns with expenses, pressure compounds.

Bills do not wait for settlement. Grocery needs do not pause for clearing windows. Emergencies do not care about processing cycles.

Households respond behaviorally. They hold higher buffer balances when possible. They rely on revolving credit during gaps. They experience anxiety when balances dip — even if income is steady.

This dynamic explains patterns explored in mid-year anxiety, where stress spikes not because earnings fall, but because timing pressure intensifies around tax seasons, benefit shifts, and expense clustering.

It also underlies financial fragility among households that look stable on spreadsheets but struggle in daily liquidity reality.

The system produces emotional outcomes — even though it operates mechanically.

The Institutional Layer Beneath Every Deposit

Settlement timing exists because institutions manage massive interbank risk.

Banks cannot simply credit funds instantly without confirmation. Payment networks batch and verify to ensure accuracy. Central clearing systems reconcile flows to prevent cascading errors.

These structures protect the financial system from instability — but they shift timing risk onto households.

Institutions operate in windows. Consumers live in continuous time.

The Federal Reserve documents how payment settlement processes prioritize system reliability over real-time liquidity, particularly across ACH and government payment infrastructure. Those protections keep markets stable but inherently slow household cash availability.

This is not inefficiency. It is intentional design. But it means households function downstream from institutional timing.

Why Income Alone Fails as a Stability Measure

Traditional financial advice emphasizes increasing earnings. While income growth helps long-term resilience, it does not solve short-term liquidity friction.

A higher paycheck that clears late still causes overdrafts. A strong salary with clustered expenses still produces cash stress. Irregular timing still triggers reliance on credit.

Stability comes not only from how much you earn, but from how predictably liquidity arrives relative to obligations.

This is why many households experiencing margin collapse do not necessarily suffer income loss — they suffer timing breakdown when buffers disappear and settlement gaps become exposed.

Liquidity is the bridge between income and life. When that bridge narrows, stability cracks.

The Structural Truth About Financial Security

Household security emerges from three forces working together:

- Income level

- Expense structure

- Liquidity timing

Most financial narratives focus on the first two. The third remains largely invisible — yet often determines whether families feel stable or stressed.

When deposits align smoothly with obligations, households feel in control. When timing drifts, even strong earners feel pressure. This is why emergency funds work: they neutralize timing risk more than income risk.

They provide immediate liquidity regardless of settlement schedules. And this is why payment delays create outsized stress compared to small income fluctuations.

The human experience reflects system design.

The Bottom Line: Stability Is About Flow, Not Just Earnings

Money does not simply arrive in households. It moves through institutional systems governed by settlement mechanics, clearing windows, and risk controls.

Liquidity timing — the moment funds become usable — shapes everyday stability far more than monthly income totals alone.

When timing aligns, households feel secure. When timing slips, stress builds — even with steady earnings.

Understanding how U.S. money actually moves reveals why financial health depends on flow structure as much as earning power. For a deeper system-level view of how deposits travel before reaching consumers, revisit the core mechanics in our pillar on the U.S. money movement framework.

Stability is not emotion. It is timing. And timing is built into the system.